Nice Info About How To Be Public Accountant

Ad get real cpa exam questions and comprehensive explanations.

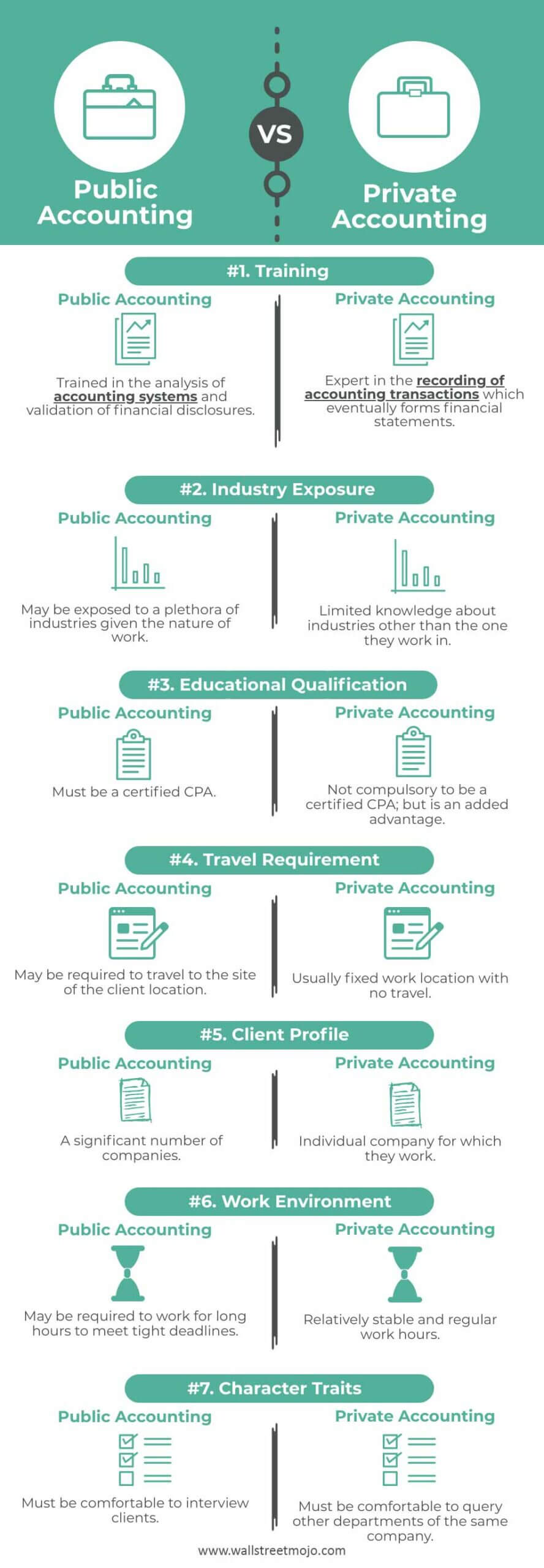

How to be public accountant. Public accounting refers to rendering services like bookkeeping, taxation, audit, and consultancy to clients within or outside the country. Learn skills in financial accounting, auditing, federal income taxation and more Know your state board's minimum requirements.

Public accounting firms employ large numbers of certified public accountants (cpas). Roger's energy + uworld's revolutionary qbank will help you get to the finish line. Create and review budgets and expenses.

Cost varies by pace, transfer credits, other factors. Certified public accountant (cpa) the cpa license is the foundation for all of your career opportunities in accounting. Ensure you have met all registration requirements listed in requirement for registration as a public accountant.

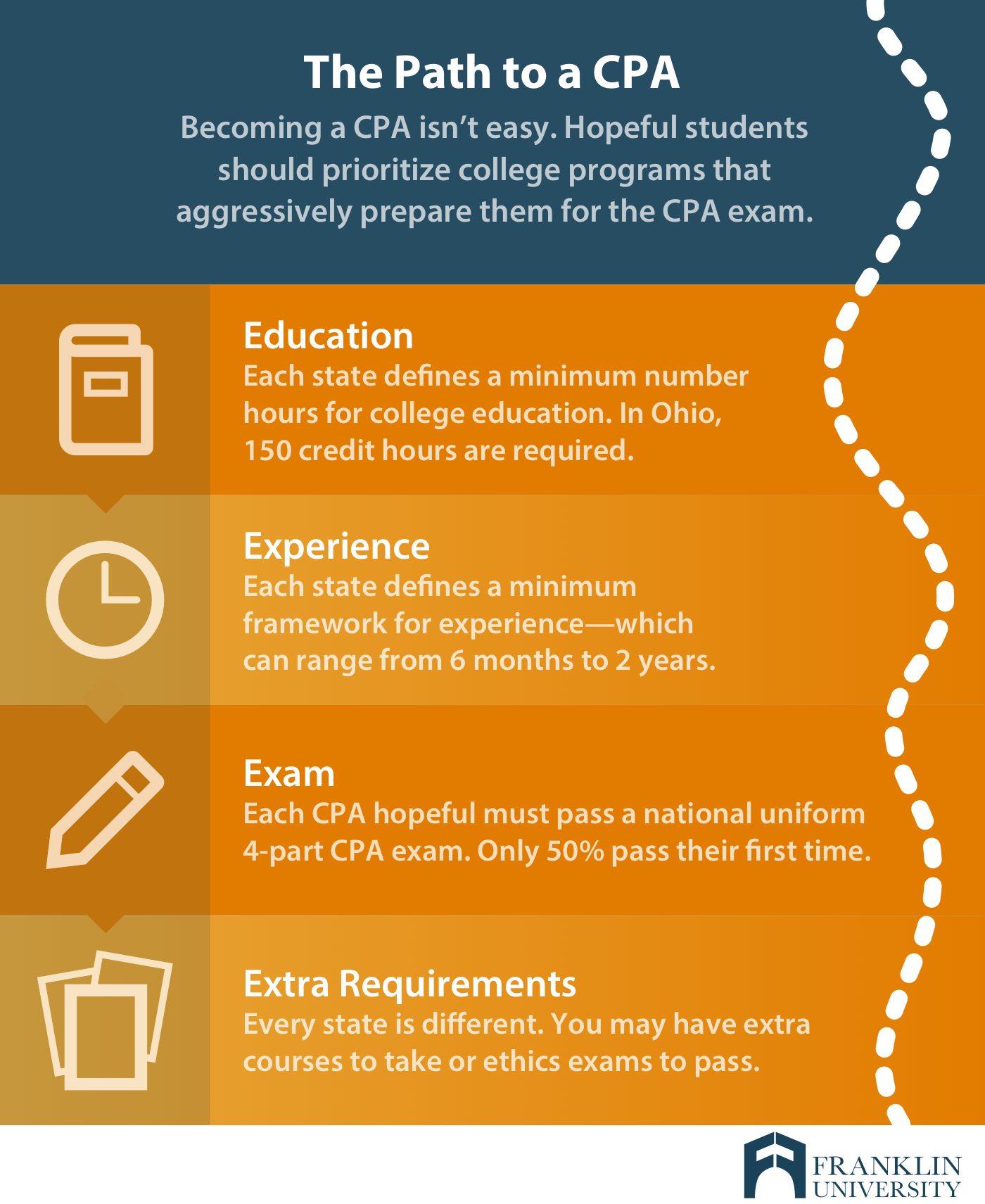

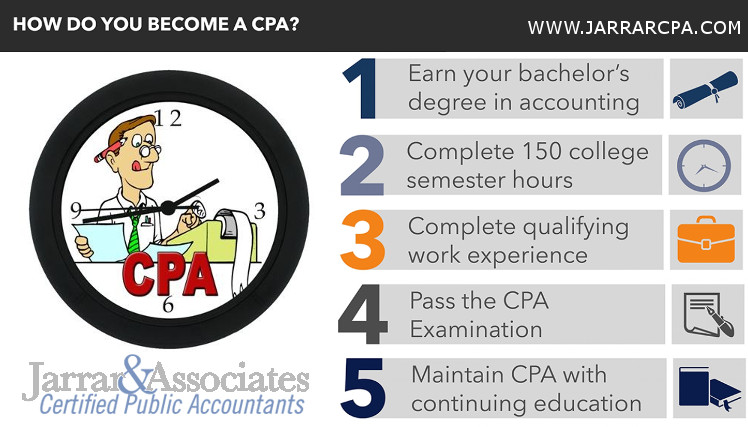

Steps to become a certified public accountant #1 fulfill the educational requirements #2 apply to take the cpa exam; Follow these steps to become a certified public accountant: Potential timeline for becoming an accountant:

The certification was originally intended to designate a person as being qualified to. Public accountants typically need at least a bachelor degree in accounting, business, or other related field. If you're interested in becoming a public accountant, one of the first things to consider is how much education you need.

To be eligible for registering as a public accountant, you must meet the following registration requirements:(i) at least 21 years old; Research and decide on the university program you wish to pursue. Ad pass up to 80% faster.

/certified-public-accountant-or-cpa-careers-1286929-669aa33715f442248c7fbf1ef97898ee.png)