Impressive Info About How To Reduce Interest Rates On Credit Cards

Web learn how credit card interest is calculated and find out how to reduce the amount of interest you pay over time.

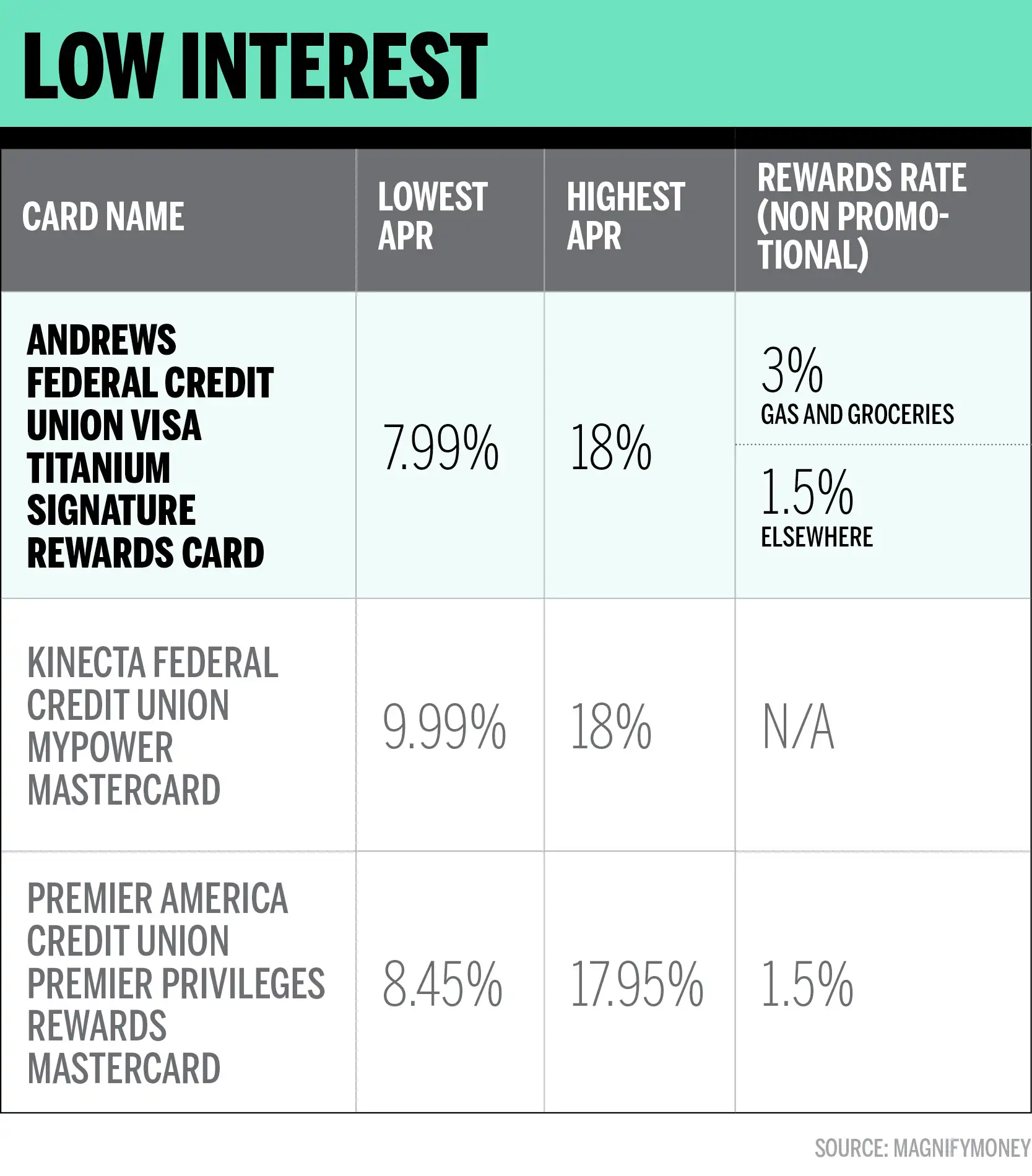

How to reduce interest rates on credit cards. Contact your credit card issuer and explain why you would like an interest rate. Web for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate or, with the right account, provide a. Web ways to lower your credit card interest rate.

Web other ways to lower your credit card interest rate. Web can you get a lower apr on a credit card? Web the worst they can do is say “no.”.

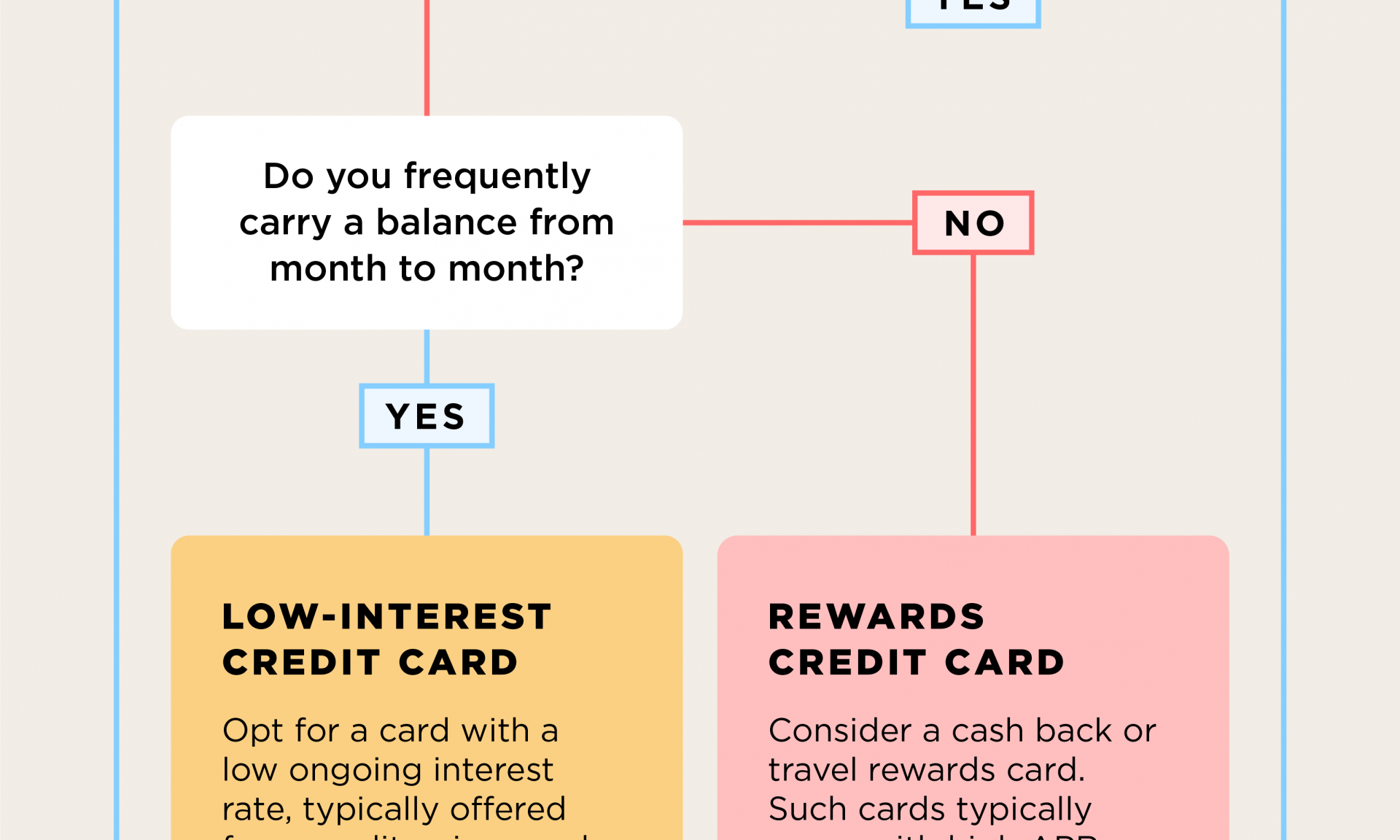

Web on a $300,000 loan, a rate of 3.11% results in a monthly payment of about $1,283, jacob channel, senior economist at lendingtree, said. Many people don’t understand how credit card apr works. Web if you consistently carry a balance on a credit card and this is costing you in terms of interest and finance charges on your monthly bill, one great way to help is to.

Web new york (ap) — for citibank credit card holders, there is one way to escape the bank's rate hikes currently under way: Web the best way to reduce credit card debt step 1: While there are no guarantees, the first step to lower your interest rate is to call the customer service.

Once you’ve researched the competition and worked to improve your chances of getting approved for a lower interest rate, it’s time to. On the back of each credit card there’s a customer service number. Requesting a rate reduction isn't the only way to score a lower rate on your credit card.

This is the number you’ll want to call. First call your creditors to negotiate lower interest rates. Web many credit cards have high interest rates, but you aren't necessarily stuck paying a fortune.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

![6 Best Low Interest Credit Cards [October 2022] - Wallethub](https://i.ytimg.com/vi/SMzGl4q1xKY/maxresdefault.jpg)