Build A Info About How To Get Rid Of Pmi Payments

Check out the latest info.

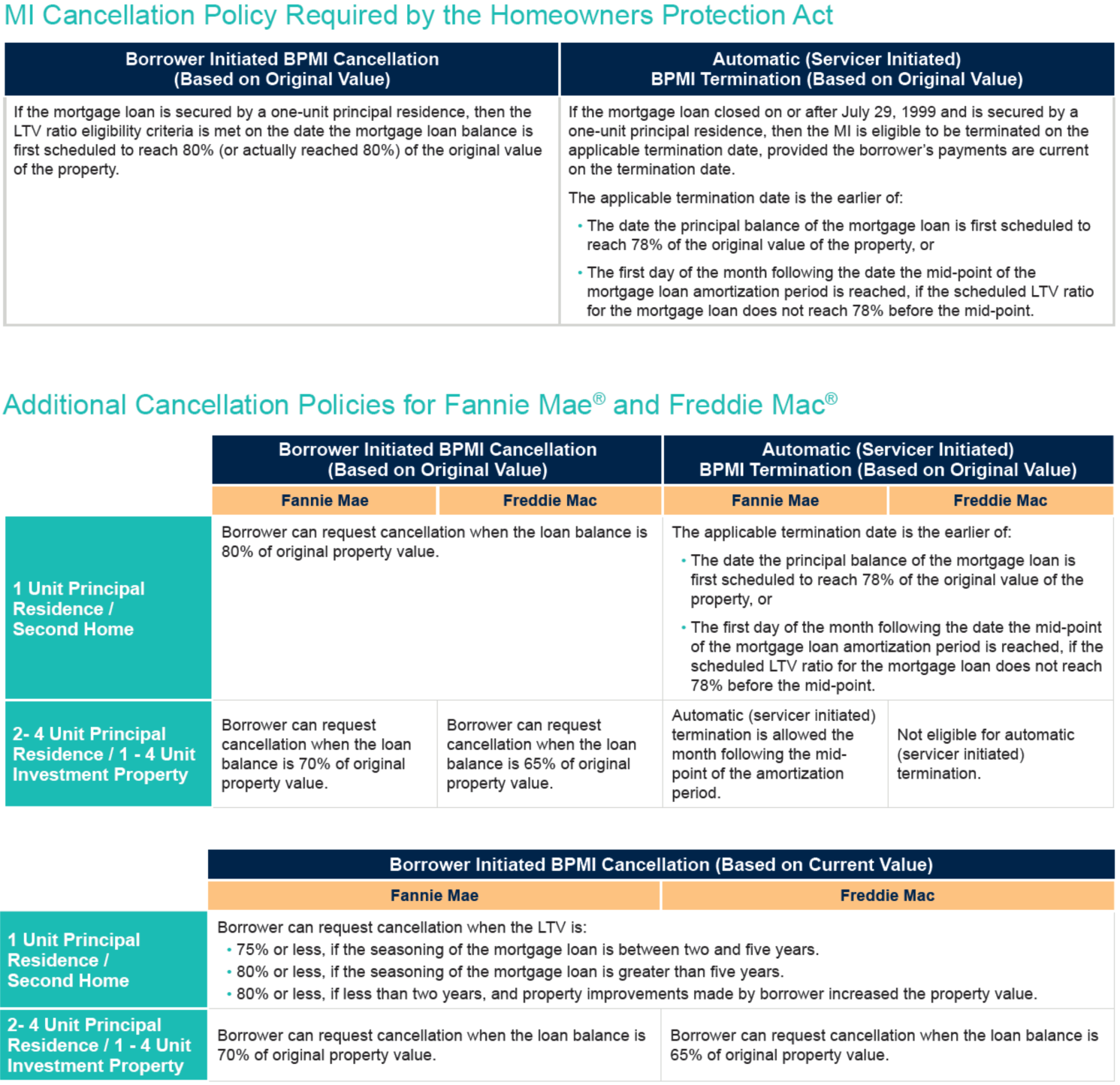

How to get rid of pmi payments. Your lender must automatically drop pmi when your loan value has reached 78% of the. After a certain amount of time, your pmi will automatically disappear. Quickly check if you qualify for this homeowner relief package (fast & easy)

If you have an fha loan term of more than 15 years, have been paying it for at least 5 years, and have an ltv ratio of 78% or less, pmi can be removed from the loan. You can get rid of pmi, however, or get a mortgage from a private lender without pmi if you have a large down payment. Ad 2021's top 5 credit repair companies.

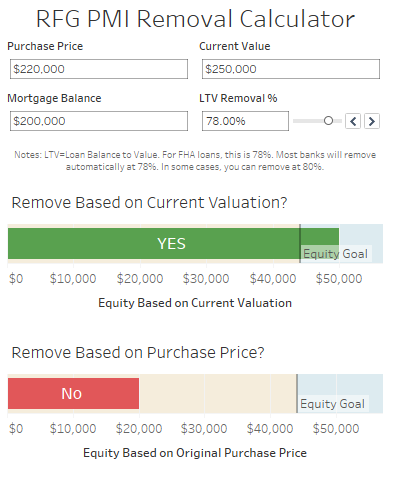

If you do decide to put less than 20% down and opt for pmi, here are three ways to get it taken off and reduce your overall costs. A pmi policy costs around 0.5% to 2% of the total. Reduce your ltv ratio to 78% the most consistent way of removing private.

If you could confirm these ltv numbers through a professional home appraisal (paid for at your own expense), you could ask your lender to remove your pmi. Ad remove pmi from loan. Take advantage of the government gse's mortgage relief product before it's too late.

If requested by your lender, confirm that you have no additional loans on the property, such as a home equity loan or home equity line of credit. Afcc & bbb a+ accredited. Ad imagine the feeling of not having the burden of a morgate payment looming every month.

Get expert help with your credit score. Usually, this happens either when your mortgage balance reaches 78% of the appraised value of the home, or when your. Ad one low monthly payment.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)