Stunning Tips About How To Fight A Credit Card Lawsuit

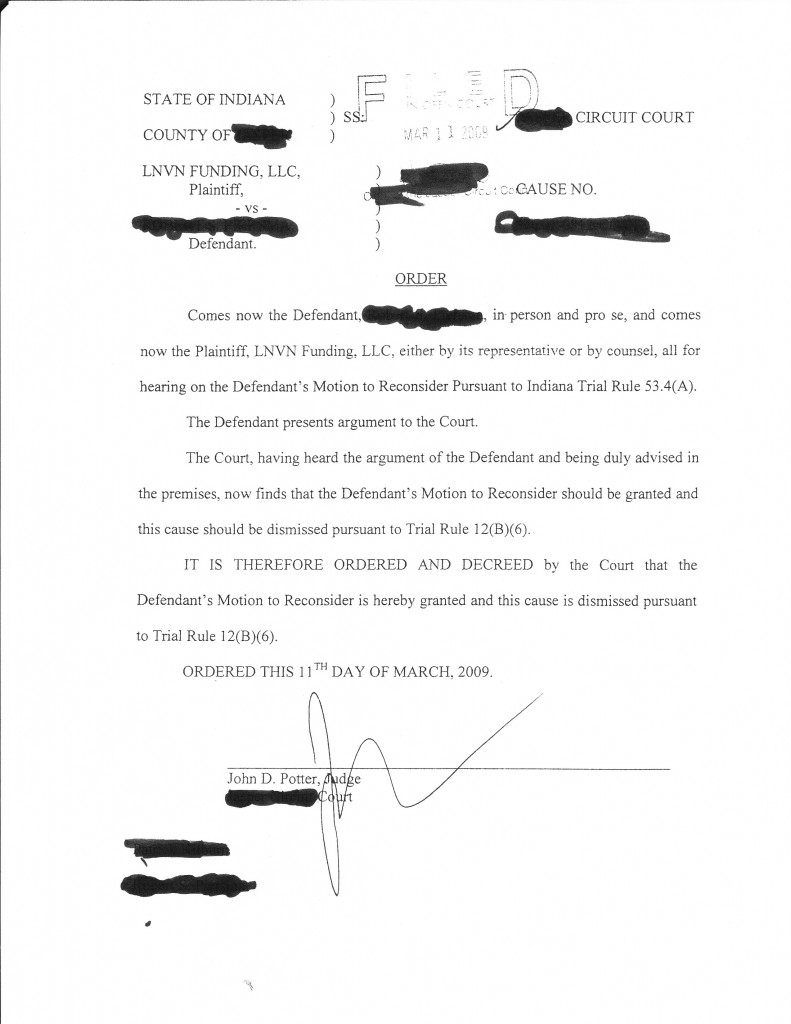

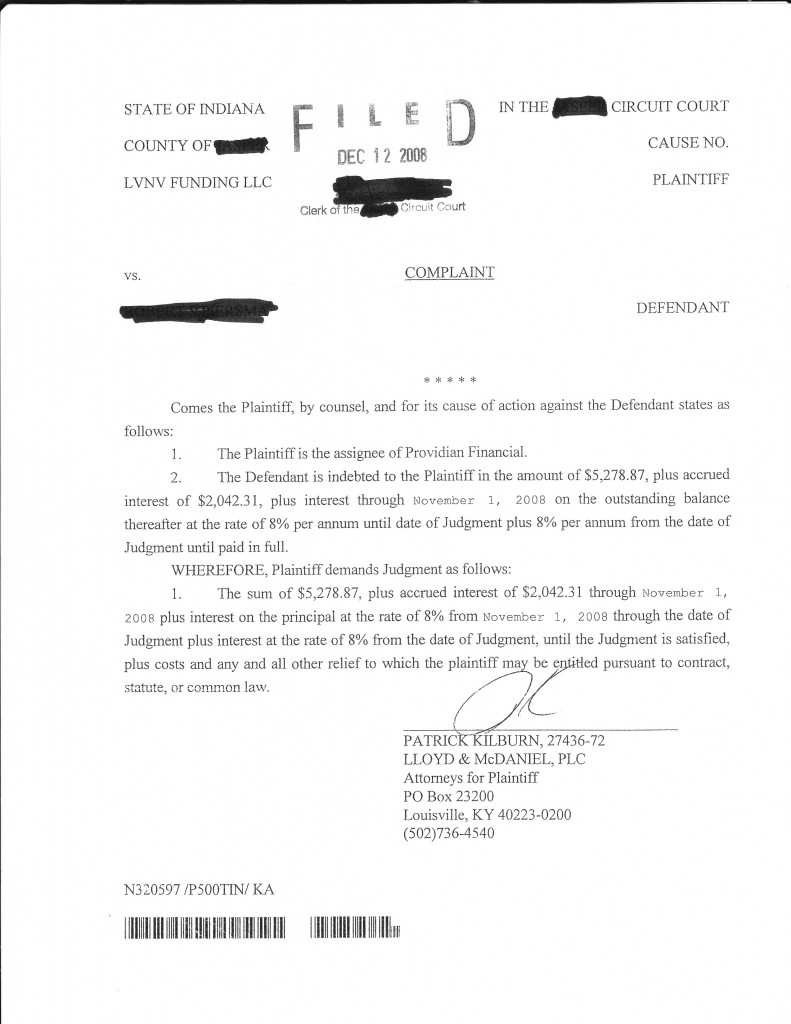

The credit card company must file a lawsuit within four years after your debt became due or the case will be dismissed because it’s outside the statute of limitations.

How to fight a credit card lawsuit. Go through your financial records. (to learn more, see our credit cards in bankruptcy area.) mistaken identity if you have been sued. Ask the company to forgive the rest and cancel the lawsuit.

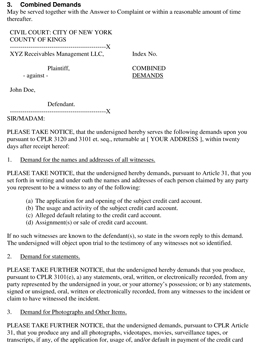

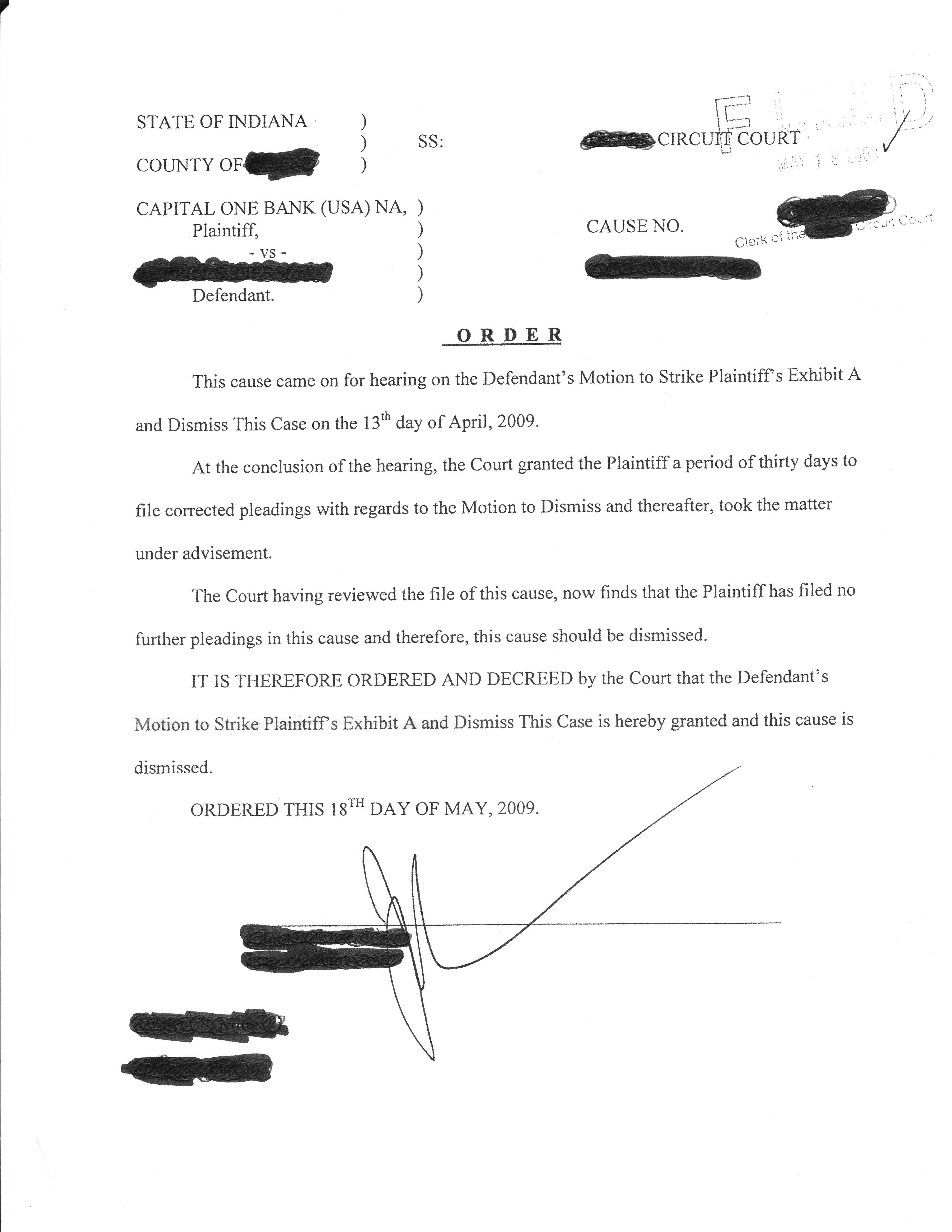

If you decide to fight the credit card lawsuit, however, they’re totally unprepared for you. 5 if you have been involved in a credit card lawsuit, you may want to contact a professional that specializes in these types of lawsuits. Request a copy of the original credit card agreement that you signed.

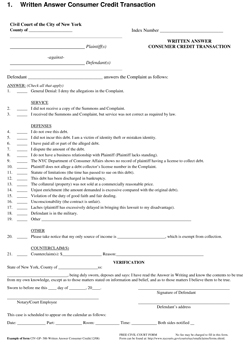

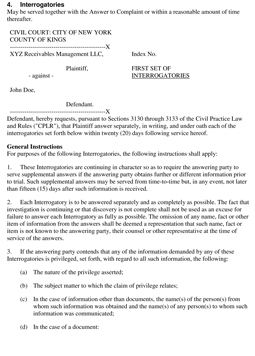

Answer/affirmative defense, sworn denial, motions). This should be your name. One of the first things that these people need to do is to.

Your privacy is protected and your personal information will not be disclosed. Ad find the right lawyer in your area. More often than not, your debt has changed hands multiple times before the current collection agency purchased it and is now suing you for it.

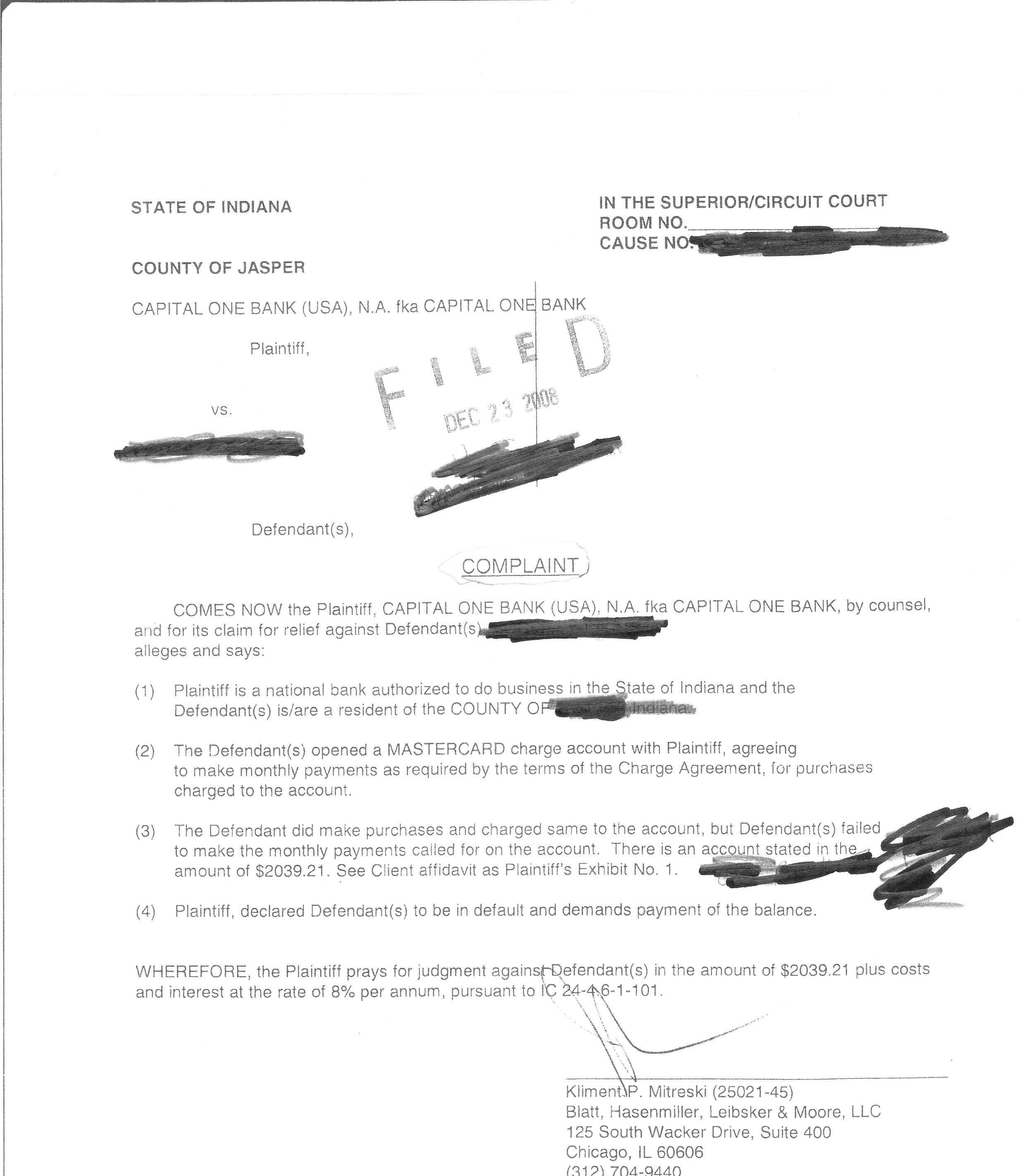

Request proof that the debt was assigned, i.e. It applies to suits over. If the lawsuit is for a credit card debt and there are charges on the account which were the result of a data breach or ‘identity theft’ where someone charged your credit card, you would have an.

How to fight a credit card lawsuit 1. Over 4 million cases posted. If you have been sued for failure to pay your bill, you should try to gather.